Libyan Investment Authority (LIA) has told Reuters that it will begin this month preparations to start reporting consolidated financial statements, after announcing it has $68 billion in largely frozen assets following its first internal evaluation process in years.

Africa's largest sovereign wealth fund, LIA, is working to regain the trust of the international community after the United Nations froze most of its assets during the 2011 rising that toppled Muammar Gaddafi.

It said this month its first asset valuation since 2012 had revealed assets of $68.35 billion at end-2019 compared to $67 billion in 2012.

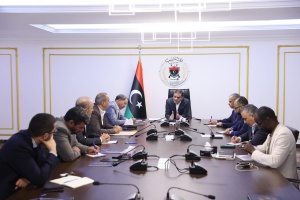

LIA Chairman, Ali Mahmoud, told Reuters in an interview that they are now planning to begin releasing financial statements on an annual basis, adding that LIA was preparing statements with EY acting as auditor.

"It may take a year and a half to publish the final financial statements once they had been audited. Through this process we will have a solid foundation for proceeding to invest. These are successes in governance and compliance with the Santiago Principles." LIA explained.

LIA Chairman also said that LIA was now compliant with 17 of the 24 principles, which aim to promote good governance, accountability, transparency and prudent investment practice.