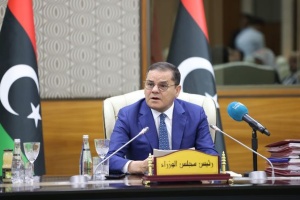

The Libyan Prime Minister Abdul Hamid Dbeibah spoke about four risks facing Libyan investments in Africa. His notes were made during an expanded meeting on Monday to follow up on investments in African countries.

Dbeibah said the risks were represented by insufficient capital, nationalization used by a number of African countries without formal legal procedures, and the termination of the period of granted licenses, in addition to various issues with contractors, banks, and government partners in most African countries, according to a statement by Dbeibah government's media platform.

The meeting was held in the presence of the Prime Minister’s personal envoy to Africa, the Minister of Youth, the Chairman and members of the Board of Directors of the Libyan Investment Authority, the General Director of the Libyan Foreign Bank, the Chairman of the Board of Directors of the Libya Africa Portfolio, the directors of the companies affiliated with the Portfolio, the Director of the Department of Institutions and Cooperation at the Ministry of Finance, and the Head of the External Disputes Department in the Department of Finance, and the Minister of State for Cabinet Affairs.

Dbeibah stressed the need to continue serious and continuous legal work in cooperation with international legal offices, and to establish partnerships with reliable parties on good terms, considering this to be the first option at this stage.

Meanwhile, the Director General of the Libya Africa Investment Portfolio, Mohamed Al-Miladi, gave a presentation that included the portfolio’s activity in Africa and the difficulties facing the portfolio in all countries. He described the current situation of the portfolio as “positive” compared to previous years.

The Director of the Department of Institutions and Cooperation reviewed the debts of the Libyan state in the African continent granted before the year 2011, the efforts made to collect them, and the progress achieved in the collection process since 2023.

The Director of the Libyan Foreign Bank, Khalid Al-Konsul, said that Burkina Faso’s decision to nationalize a joint bank with Libya is an illegal measure, which was made “despite the efforts by the Libyan Foreign Bank and the Ministry of Foreign Affairs with Burkina Faso's side for a legal settlement.”

Last Thursday, Burkina Faso government announced the nationalization of the Libyan Arab Bank for Trade and Development, which was established in partnership with the Libyan Foreign Bank, claiming that it aims to ensure better governance of the bank.